RD Johnson Law Offices

Our Business is Helping Businesses and Individuals Protect Assets

About R.D. Johnson Law Offices

For many years, R.D. Johnson Law Offices has not spent any efforts on advertising, as our clients come primarily from referrals from our many satisfied clients. R.D. Johnson Law Offices strives to provide premier and careful planning and transactional services at a fair, honest and reasonable price.

Areas of law

Estate Planning

RDJ LAW has 23+ years of Estate Planning experience in establishing Estate Plans for individuals and married couples.

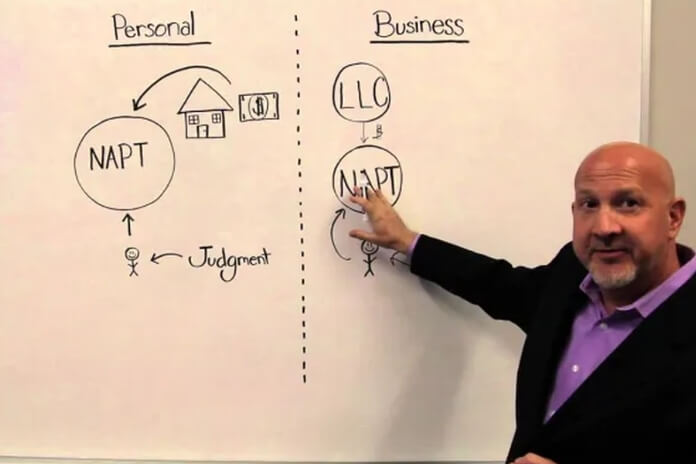

Asset Protection Planning

Everyone has some risk of being personally involved in a lawsuit which may result in a personal legal judgment.

Protection Of Real Estate Investments

RDJ LAW has been helping real estate investors to protect their Real Estate Investments from risk of loss in the event that a personal judgment happens.

Protection Of Business Assets And Investments

RDJ LAW devises unique and effective protective strategies to accomplish this type of protection that most attorneys do not.

Nevada LLC And Corporation Formation And Maintenance

The Nevada business entity laws are structured so that the business owner has maximum shielding from personal liability from a business liability

What Our Clients Say About Us

Clients Testimonials

Robert Johnson has been my attorney for many years and has handled all of my estate planning. I value his integrity and reliability and I can't imagine using anyone else.

Alex H.

Robert was very professional from the beginning. He is always quick to respond and I always felt that my case was a priority for him. I will definately trust him with any future legalities that may arise for me.

Eric R.

Great Attorney and has provided me multiple LLC's, trusts and other documents. Has been involved in mediation and settlement conferences for my company.

Ned S.

I own an accounting firm in Las Vegas, Rob is always available to our clients (even on Sundays when we had clients from out of the country). Rob always provides a detailed explanations and on going support to our clients. thank you Rob!

Bob N.

Rob was a pleasure to work with. Always extremely responsive, professional and knowledgeable. We were in a very bad situation and having Rob assist in the matter made a world of difference. I highly recommend him.

John D.

RD Johnson Law Offices

We will also help and advise in these areas of practice:

Founder of the firm

Robert D. Johnson

R.D. Johnson Law Offices, LLC (aka: RDJ LAW) is headed by Robert D. Johnson. In the earlier years of his law practice, Mr. Johnson engaged in business and personal litigation matters, Bankruptcy and Entertainment Law (both as Entertainment Lawyer and as an Artist Manager). For many years, Mr. Johnson’s primary focus has been in the areas of Trusts, Personal and Business Asset Protection Planning, Estate Planning, Business and Real Estate transactions.

What Other Attorneys Say About Us

Attorneys Testimonials

Whether you are forming a business entity in Nevada or wanting to file one elsewhere, I would talk to Rob Johnson. He knows the pros and cons of where to form a business, based on the client's specific needs, and knows the best way to protect both the interests of the business, while protecting the interests of its founders and officers. Rob's legal ethics and knowledge in this area are superior.

I have known Rob for over 25 years. During that time I worked with him on numerous matters. I never had any reason to question his ethics, legal approach, judgment, or knowledge. In fact, I regularly call Rob if I have unique legal or ethical questions, or if I have any questions concerning trusts, estates, or corporate/entity formation. He is extremely helpful to work through the issues and he provides well reasoned, and legally grounded pragmatic advice.

I refer all of my clients' estate planning needs to Rob. He takes the extra time to explain all the complexities and make sure that his clients get exactly what they need and want. His knowledge and experience in estate planning is unparallele...

Rewards & Awards

Achievements in recognition awards and rewards

Let's Talk?

Schedule free consultation now

RDJ Law Library

The Nevada asset protection trust can protect your assets

Protect Your Business Income A Nevada Business Holdings Trust is a Nevada Asset Protection Trust that is designed by RDJ LAW to hold the…

The Nevada homestead exemption increases in 2022

Significant Changes to the Nevada Homestead Law that are Effective in 2022 Due to changes made to Chapter 115 of the Nevada Revised Statutes…

What does a living trust do and how does it work?

What Role Does a Living Trust Play in an Estate Plan A Living Trust (a/k/a: Family Living Trust, Family Revocable Living Trust, Revocable Living…